ANSWER: Call the bankruptcy clinic at Oregon legal aid at 503-224-4086. You may qualify for a pro bono attorney to help wipe out your student loans in bankruptcy. If not, you will need to file bankruptcy without an attorney “pro se”.

File Your Bankruptcy Complaint

After you file bankruptcy, you must file a complaint against your student loan companies. Click here for a sample complaint. Your complaint should list all your student loan companies. Make sure your complaint explains every box you marked on your quiz. Read our FAQ again one last time before starting the bankruptcy process. Can you make lifestyle or budget changes that will allow you to honestly check more boxes? The more boxes you can check, the more likely your judge is to discharge your student loans. The longer you can wait to file bankruptcy after receiving your student loans, the better your odds of wiping them out.

Before filing your complaint, you must file a bankruptcy case and get a bankruptcy court case number. Call legal aid to see if you qualify for the bankruptcy clinic. The clinic pairs low-income Oregonians with pro bono bankruptcy attorneys.

Mail Your Complaint and Summons

The court will send you a summons a few days after your complaint is filed. Mail the summons and complaint to each student loan company on your list, and to the following addresses:

The court will send you a summons a few days after your complaint is filed. Mail the summons and complaint to each student loan company on your list, and to the following addresses:

United States Attorney’s Office

District of Oregon

c/o Civil Process Clerk

1000 SW Third Ave Suite 600

Portland, Oregon 97204

United States Department of Justice

c/o Attorney General

950 Pennsylvania Avenue, NW

Washington, DC 20530

U.S. Department of Education

c/o Secretary of Education

400 Maryland Avenue, SW

Washington, DC 20202

The court will schedule your first hearing within a month or so. You can usually call in by phone.

File Your Certificate of Service

The summons you got from the court came with a certificate. Return the completed certificate to the court.

The summons you got from the court came with a certificate. Return the completed certificate to the court.

Fill out a separate certificate for each student loan company named in your complaint, and for each address for the Department of Education listed above.

If you fail to properly serve a student loan company, the judge may be unable to forgive your student loans at the end of your case.

Exchange Documents and Information

Before trial, you will exchange documents and information with your student loan companies. You must cooperate and answer their questions as best you can.

Before trial, you will exchange documents and information with your student loan companies. You must cooperate and answer their questions as best you can.

The student loan company may want to ask you questions under oath during a deposition. You may want to ask the student loans companies questions too, and request their documents. View a sample notice you can use to schedule your student loan companies’ depositions.

View sample requests for production and requests for admission you can send your student loan companies during discovery. Use requests for production to see what documents the student loan company may use to argue your prospects are actually better than they are. You may want to see the opposing party’s documents before trial so you are prepared to explain them to the judge. Use requests for admission to narrow the factual issues for the judge to decide at trial.

Student Loan Trial

At trial, tell the judge your story and talk about everything you marked on your quiz. Bring copies of the paperwork you want the judge to see. You might contact the Oregon State Bar consumer section in the months before trial. Request a new lawyer looking for courtroom experience to help you at trial.

At trial, tell the judge your story and talk about everything you marked on your quiz. Bring copies of the paperwork you want the judge to see. You might contact the Oregon State Bar consumer section in the months before trial. Request a new lawyer looking for courtroom experience to help you at trial.

If you live near Portland, your trial will likely be held at 1001 SW 5th Ave #700, Portland, OR 97204, (503) 326-1500.

If you live near Eugene, your trial will likely be held at 405 E 8th Ave #2600 Eugene, OR 97401, (541) 431-4000.

Before trial, the student loan company attorney will want you to produce all your documents and answer requests and interrogatories. Do the best you can. If you don’t have a computer at home, ask if handwritten answers are acceptable.

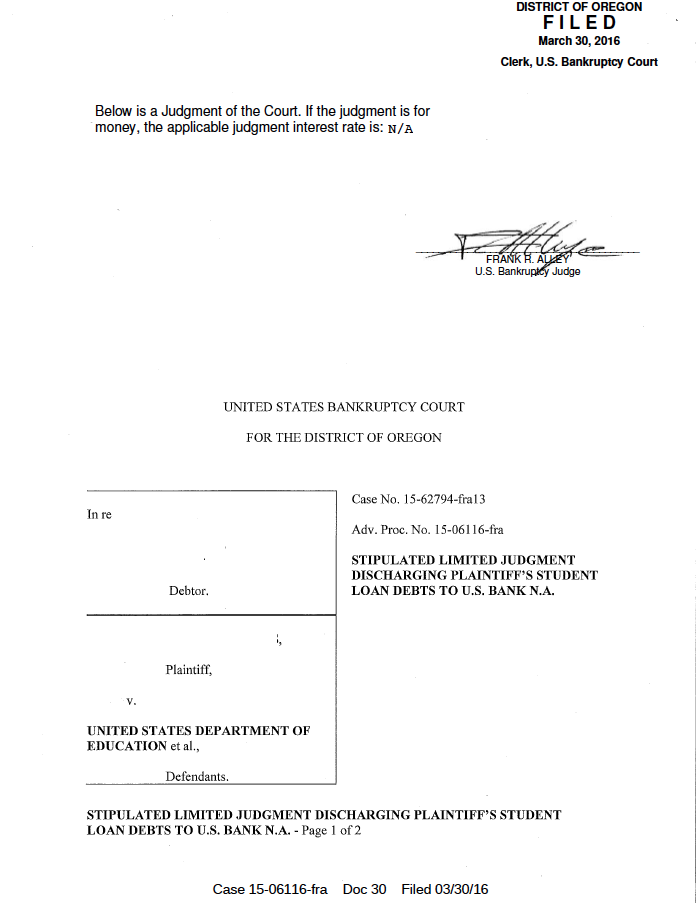

Judgment Discharging Student Loans

After trial, the judge will decide whether or not to wipe out your student loans. You may obtain a full or partial discharge, or no discharge at all. To qualify for discharge, you must prove that it would be an undue hardship for you and your dependents to pay back your student loans. Click here to learn more about the undue hardship exception. Sometimes a student loan company will not object to your complaint. In this scenario, you can enter a stipulated judgment. Other times, a student loan company will not appear at all. In this scenario, you will need to file a motion for default judgment.

After trial, the judge will decide whether or not to wipe out your student loans. You may obtain a full or partial discharge, or no discharge at all. To qualify for discharge, you must prove that it would be an undue hardship for you and your dependents to pay back your student loans. Click here to learn more about the undue hardship exception. Sometimes a student loan company will not object to your complaint. In this scenario, you can enter a stipulated judgment. Other times, a student loan company will not appear at all. In this scenario, you will need to file a motion for default judgment.